“Travel money tricks” is the third of three posts that we have recommended you read if you are new to the currency exchange market in Spain. The first is called “Currency exchange: fx vs travel money” and the second “Where to change foreign currency in Spain“. If you have not done it before, we advise you to read those two first before this post. They will help you to be a currency exchange champion in Spain.

Tricks for your currency exchange

If you need to change money for a holiday in Spain (or out of the country), we present some quick tips and tricks to get more out of your euros and get more foreign currency in return. We also want to prevent you are not scammed when you return back home with left over travel money in your wallet.

Know how to differentiate fx currency exchange from travel money currency exchange

Although colloquially we use fx currency and travel money interchangeably to refer to the same (currency exchange) they are different things as we explain here. Just the same way we could compare the barrel of Brent crude and its price with the petrol we put in our car.

Currency exchange (fx) is a large-scale movement (between banks) of balances between bank accounts expressed in two different currencies. Currency exchange is the physical exchange of banknotes of one currency for notes of another currency, applying a currency exchange rate to the operation.

Do not trust currency converters

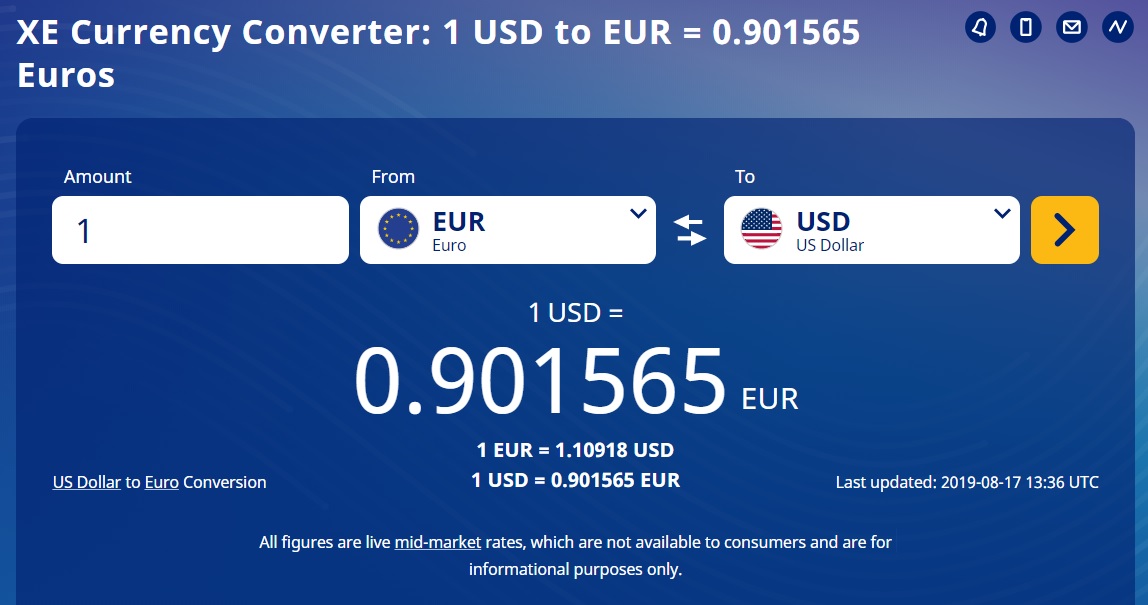

Currency converters (Oanda, XE, Coinmill, Cuex, etc.), show you the exchange rate at which money is exchanged in different currencies (not physical currency) between banks and large companies.

These are rates that you will not find at high street level as a consumer or traveler.

Currency converter XE

They usually warn you in the small print below the converter:

All figures are real-time medium market exchange rates, which are not available to individual customers and serve as a reference only.

Don’t make a scene at the bureau de change or bank

Related to the above. If you are going to exchange currency in a bank or at a currency exchange supplier there is no need to make a fuss with the exchange rate that they offer you.

You do not need to show the rate on your mobile as stated by a currency converter. As we have seen, these are rates that are not comparable: fx has nothing to do with travel money in banknotes.

It is as if you are claiming Repsol, Cepsa or Campsa petrol station, the price per liter of gasoline from the barrel of Brent crude price.

Cards are not accepted everywhere

If you are part of the trusted and “techies” who only pay with your mobile or your prepaid card, keep in mind that they will not be accepted as a payment mean everywhere you travel.

This being so, it is always good to carry banknotes from the destination country by hand, just in case. A ride in a taxi or shopping at a local souvenir shop, a tour with a local guide, or an official entry or exit fee to the country may not accept your card.

And what if you lost your card? The best advice is to carry a mix of payment means when abroad.

Know where you can change currency

In addition to changing at your bank, or doing so at the airport, know the specialized currency suppliers in Spain. They are situated in many places, and usually offer competitive rates in Spain. Here we explain the differences between the three forms of currency exchange.

And please do not leave the currency exchange task for the last minute for two reasons:

- You may not find the specific currency you need last minute. Keep in mind that banks manage an average of 10 to 20 convertible currencies versus about 80 by Spanish currency suppliers. But there is not always stock of every currency in the market.

- If you leave it for the last minute, the only option you will have left in France to change money, the least interesting, will be the airport.

Know what currency you will buy and where: there are “cheap” and “expensive” currencies

The large currencies that circulate worldwide (dollar, pound sterling and yen) and European currencies are known as “convertibles”.

They are called so because they are accepted means of payment frequently exchanged between countries and their institutions. And because they are freely circulating and have more or less stable exchange rates (for fx currency and banknote travel money). The exchange rates of these convertible currencies are usually acceptable.

On the other hand, currencies with restricted circulation (usually difficult to bring with you out from the country of origin) are more expensive to obtain. We talk about the Moroccan dirham (MAD, the Colombian peso (COP), the Tanzanian Shilling (TZS) or the Angolan Kwanza (AOA) for example.

Their degree of conversion is much lower than for convertible currencies. As a result, these “exotic currencies” are much more harder to buy or sell in France or back in your country of residence.

Do not accept dollars as an all in one currency

If you are a resident in Spain and your local bank does not have the currency you are looking for, do not let them “sugar the pill” and sell you dollars that you can exchange to local currency at destination.

You´d better get euros with you and change them locally on arrival. The explanation is simple: if you are sold dollars in Spain, the bank will apply an exchange rate (and probably an additional 2-3% commission) and at the destination they will apply, again, an exchange rate and a commission.

Result: you will have been charged for two services you did not need (at least the initial euro-dollar exchange).

Before choosing the amount, ask if they will buy you the leftover

Keep in mind that in terms of foreign currency, everything that is sold is not bought. Let us explain ourselves.

There are currencies that because of their risk of depreciation or because of their very little liquidity, exchange suppliers do not buy, or do so very discreetly.

For example, currencies such as the Argentine peso are usually purchased on a limited basis from travelers from Argentina, but with safety limits. At a given limited volume, the currency supplier will not want to buy more stock of that currency until he manages to sell it to Spanish travelers and residents heading to Argentina. Therefore, if you want to buy Argentine pesos, ask before if they will buy you back the surplus on your return. If they say no, be careful with the amount of pesos you buy in Spain.

In addition there are currencies that are outside the activity of banks and currency exchange suppliers. We talk about the Cuban peso (CUP) or the Venezuelan bolivar (VEF).

Change without fear if they offer you free “buyback”

The buyback of foreign currency is a very interesting service offered by some exchange suppliers (not Spanish banks).

It is usually a free service offered if you buy over a certain amount of foreign currency. It is usually free because these exchange services know, from experience, that the percentage of travelers returning the surplus is relatively low.

They know well that travelers don’t have money left over (or have little left over and decide to keep it as a souvenir) or that they are too lazy to head to their branch to change it, once back home.

The buyback guarantee is always interesting, but keep in mind that it usually has terms and conditions applied to it:

- That you buy over a purchase threshold from which you are included for free in the price. Be careful because they could also charge you, so always ask if it’s free.

- That you return up to a maximum limit of what you buy. For example, up to 50%, or up to 70% of what was purchased. Everything that exceeds this limit you will have to sell it to them at the purchase rate of the day.

- That you return within a predetermined deadline. They are usually long terms like 30 or 50 days after the currency exchange. But keep that in mind.

Change online, it’s more comfortable

If you are a resident in Spain

If you are a resident in Spain travelling abroad, it is worth trying the online purchase websites of the exchange suppliers or your bank (few still). These services are easy to understand and have good rates:

- Select the currency you want and how many Euros you are going to buy. They tell you the exchange rate that they will apply to you.

- Provide your personal data (you are usually asked for the scanned NIE, resident permit in Spain, keep it in mind) and where you want to receive your foreign currency.

- You pay online by bank transfer (euros) or with your debit or credit card.

- You receive your money from Correos postal services or a private courier company.

Once back in Spain you may get rid of your extra currency at these very services but this time you will have to choose a store nearby where to give back the extra currency in return for euros.

If you are not a resident in Spain

Both to get euros or to buy foreign currency, head to one of our currency exchange suppliers and choose a branch close to you. You can place a reservation and head to the branch on the chosen day to get your Euros or your travel money what travelling abroad from Spain.

Recommended suppliers

These 5 currency exchange suppliers accept to cooperate with Cambiator and compete with their daily rates.

- Ria Currency Exchange (part of Euronet Wordlwide, Inc).

- Eurochange (specialised supplier in GBP and USD).

- iCambio (insert voucher CAMBIATOR on their home page to get a better rate).

- Money Exchange (get a coupon to present at one of ther branches without ado).

- Change2Go (they buy and sell all currencies from ther Madrid-based store).

- Bitex Change (they buy all currencies at their Barcelona stores).

- Money Change (they buy some popular currencies at their Torrevieja-Alicante store).

If you change at destination do it with guarantee

Beware of changing at hotels in destination. The exchange rates that they will apply to you will be very poor, if not linear (one to one rounded up exchange rates).

Do not keep loose coins

Unless you like collecting, when you go back from a trip abroad, get rid of the coins (not the notes) left in destination. Some souvernis, a last minute coffee or a donation may be fine.

And this because the exchange suppliers in Spain will only pick up from you notes, but not loose coins. The only exception we know in Spain is that of the coins of 1 and two pounds sterling (1, and 2 GBP) which are frequently used in Spain by suppliers.

Pound coins

Cambiator

Cambiator is the first currency exchange comparator for travelers. We have come to Spain to introduce transparency in the currency market and to help you find the best rates every time you change money for your trips abroad.

![]()

Recommended readings

This is the third of three posts that we have recommended you read if you are new to the currency exchange in Spain. The first is called “Currency exchange: fx vs travel money” and the second we advise you to read if you have not already done so “Where to change foreign currency in Spain“.

Other popular currencies

Best rate of the day (exchange euros to another currency)

Sin comentarios